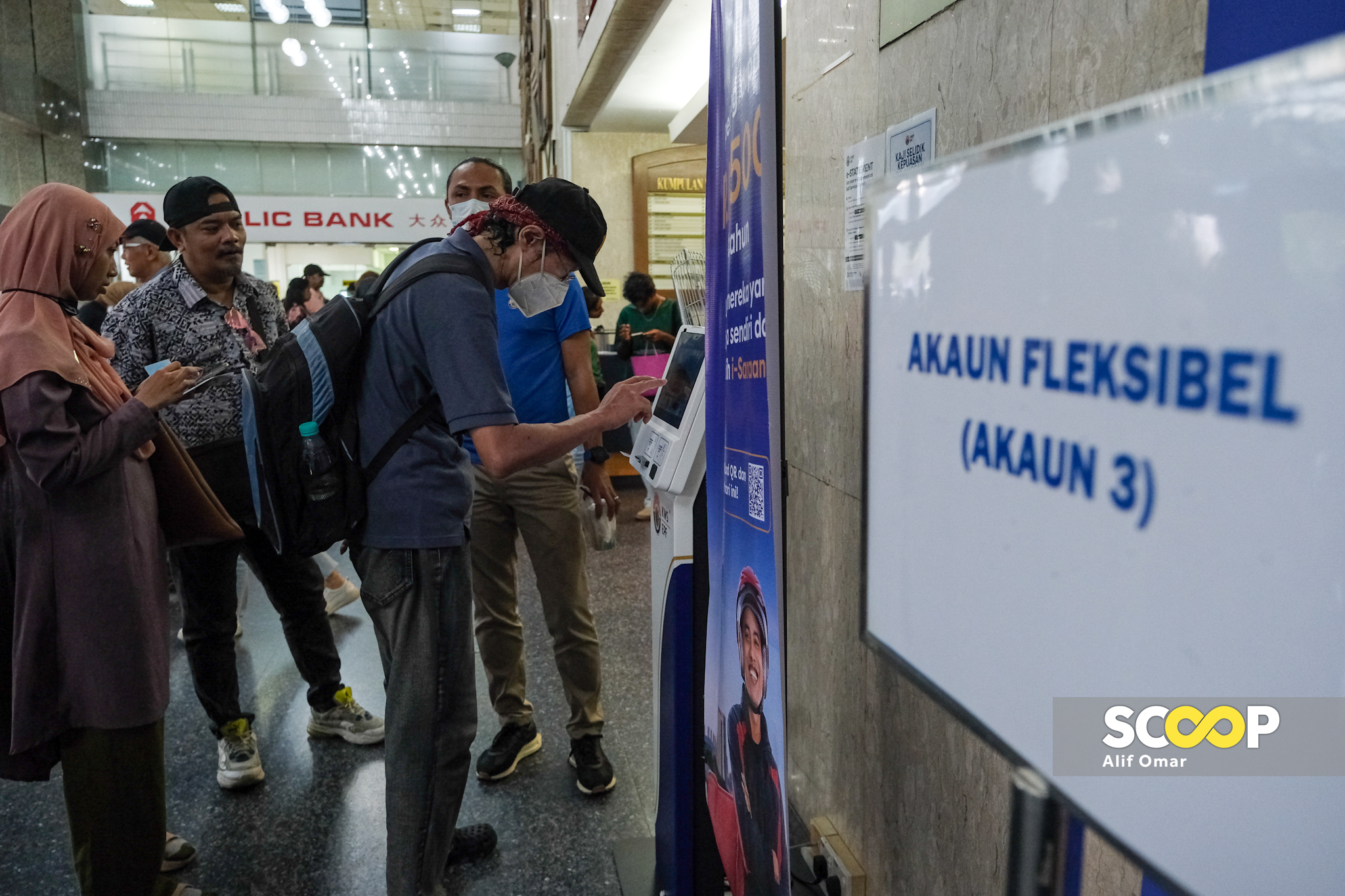

KUALA LUMPUR – A total of 3.61 million or 27.8% of the total 13.01 million Employees Provident Fund (EPF) members under the age of 55 have chosen to have the initial amount in their flexible accounts, and have transferred a total of RM11.52 billion as of June 24, 2024.

Meanwhile, a total of RM5.12 billion has been transferred to the retirement account, said the Finance Ministry (MoF).

“About 3.16 million members or 24.3%of the total 13.01 million EPF members under the age of 55 have withdrawn a total of RM7.81 billion from the flexible account,” it said on the Parliament website on Tuesday in a written reply to a question by Abd Ghani Ahmad (PN-Jerlun) who wanted to know contributors’ flexible account renewal status as of May 11.

The MoF said this initiative is a proactive step to help the people cope with the changing employment landscape, ageing population as well as changing needs according to the life cycle of EPF members.

“Among members who made the choice to have an initial amount, a total of 41,000 members who before the transfer had not achieved the basic savings level according to age, have now reached it following the transfer of part of their sejahtera account savings to the retirement account,” it said.

The MoF said the EPF will remain committed to continue to provide competitive returns to contributors in an effort to increase their retirement savings balance and prevent contributors from falling into the crisis of old age poverty.

“Member’s savings balance depends on their trend of contributions and withdrawals,” it said. Consistent contributions, and withdrawals that are only made for reasonable purposes, will help members build up their retirement savings balance, it added. – July 10, 2024