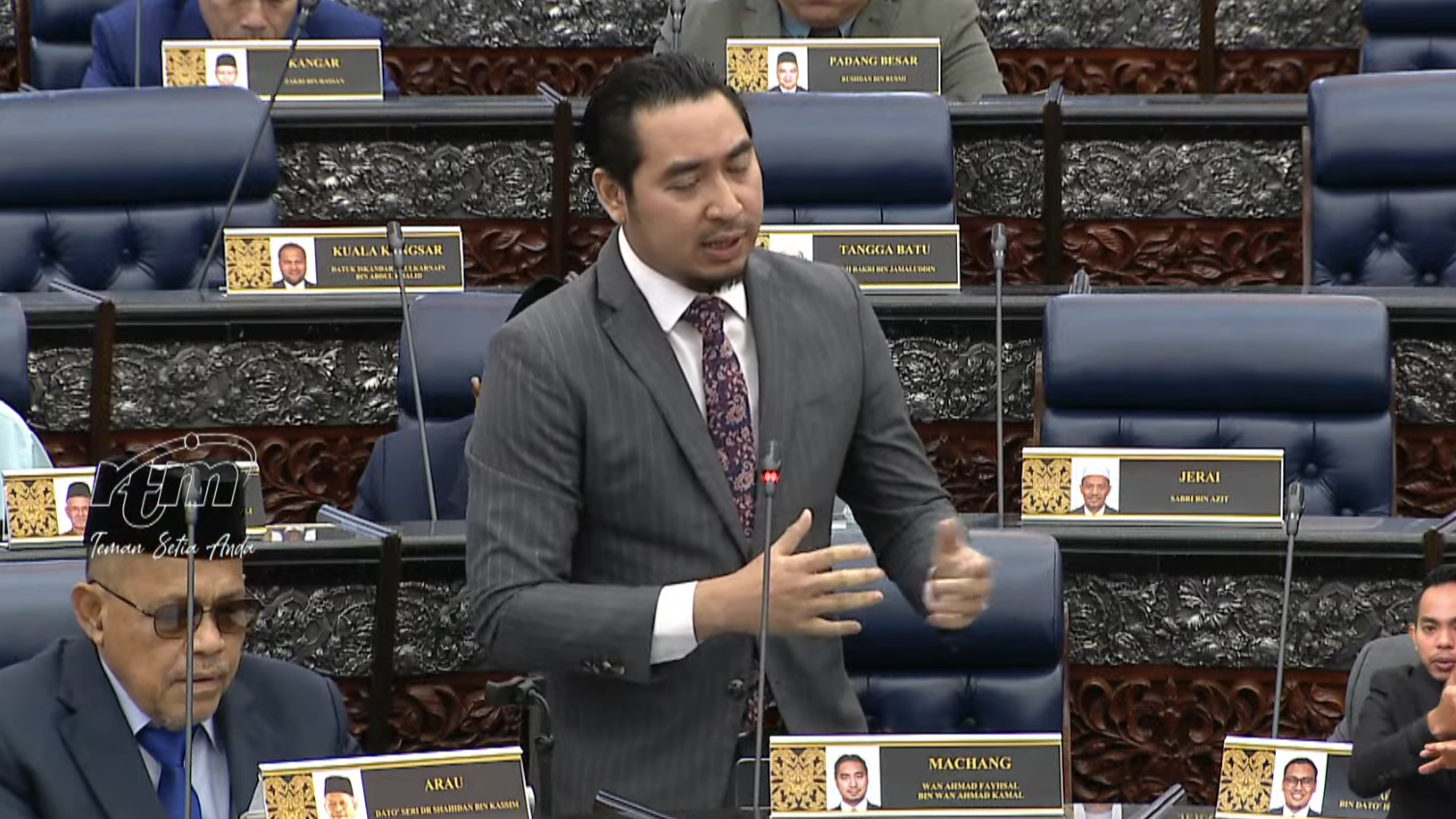

KUALA LUMPUR – Opposition lawmaker Wan Ahmad Fayhsal Wan Ahmad Kamal (Machang-PN) has raised in Parliament concerns that government investment funds are involved with global investment manager BlackRock Inc, which owns shares in weapons companies supplying arms to Israel.

Wan Fayhsal questioned Deputy Foreign Affairs Minister Datuk Mohamad Alamin (Kimanis-BN) on an alleged consortium between sovereign wealth fund Khazanah Nasional Bhd, the Employees Provident Fund (EPF) and New York-based private equity firm Global Infrastructure Partners (GIP).

The consortium, Wan Fayhsal said, is understood to be aimed at facilitating the ownership of shares in airport operator Malaysia Airports Holdings Bhd (MAHB).

“GIP is fully owned by BlackRock, which is the biggest funds manager in the world and owns shares in (major weapons contractors) Raytheon, Lockheed Martin and Northrop Grumman.

“These are companies which have supplied the weapons used to kill Palestinians in Gaza,” Wan Fayhsal said in the Dewan Rakyat.

He also urged Wisma Putra and government backbenchers to provide their assurance that they will protest the potential collaboration between Khazanah, EPF and GIP.

“What is the use of speaking (on pro-Palestine issues) at the United Nations if we work together with those who have killed Palestinians? I’m sure that the finance minister can act smarter than this,” Wan Fayhsal said.

In response, Mohamad said that while the issue raised by Wan Fayhsal is a “major” one, the ministry has yet to receive any official notice on the matter.

“We will take any necessary action based on the jurisdiction of our ministry. If the matter falls under the Home Ministry, then we will provide our views to the relevant agencies.”

Khazanah is currently a major shareholder of MAHB with an over 30% stake while EPF has an about 7% equity interest in the public-listed company, which manages a total of 39 airports nationwide.

News of the potential consortium deal was previously published by The Edge, which cited sources claiming that GIP is “well known” for running airports.

“MAHB has been having issues with the Kuala Lumpur International Airport, its main asset – problems with the aerotrain, ageing baggage handling systems and whatnot. So, it makes sense to court GIP,” the source was quoted as saying.

The news quickly made rounds on social media, with netizens questioning the move to collaborate with GIP.

On January 12, BlackRock announced its agreement to acquire GIP for total consideration of US$3 billion of cash and approximately 12 million shares of BlackRock common stock.

“The combination of GIP with BlackRock’s highly complementary infrastructure offerings creates a comprehensive global infrastructure franchise with differentiated origination and asset management capabilities.

“The over US$150 billion combined business will seek to deliver clients market-leading, holistic infrastructure expertise across equity, debt and solutions at substantial scale,” BlackRock said in a statement then. – March 4, 2024